MPO99BET.COM - Link Mpo Resmi Daftar Mpobet Situs Judi Slot Online Gacor

MPO99BET Situs Game Online Mudah Menang Di Pragmatic Play Mari Daftar Mpo99 Link Resmi Mpobet Penyedia Taruhan Deposit Bank Dana Dan Qris 10ribu. MPO99BET adalah situs game online terpercaya yang menyediakan berbagai jenis permainan seru seperti slot, sportsbook, dan live casino yang sangat popular di indonesia. Dengan reputasi sebagai platform yang aman dan berkualitas slot mpo menawarkan pengalaman bermain yang luar biasa untuk pemain pemula maupun profesional.

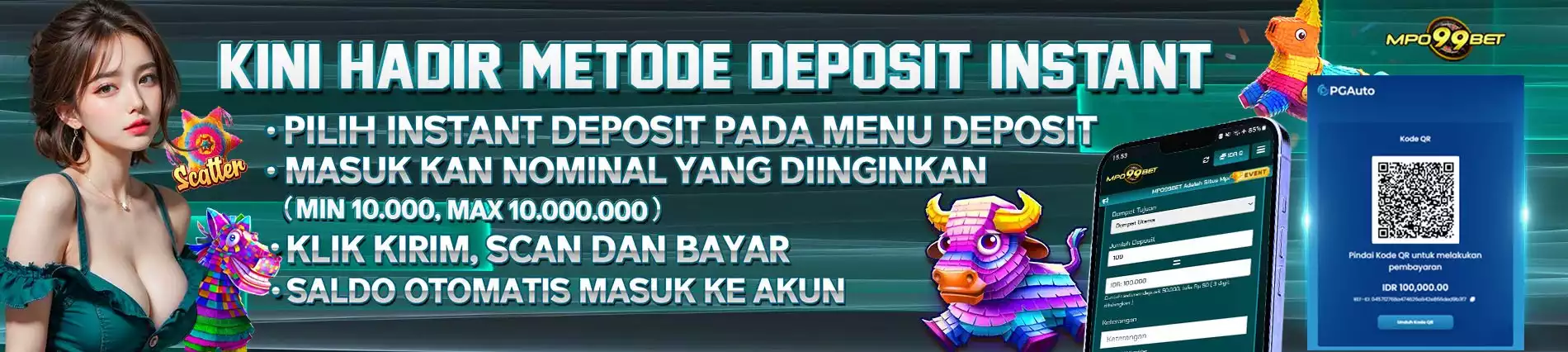

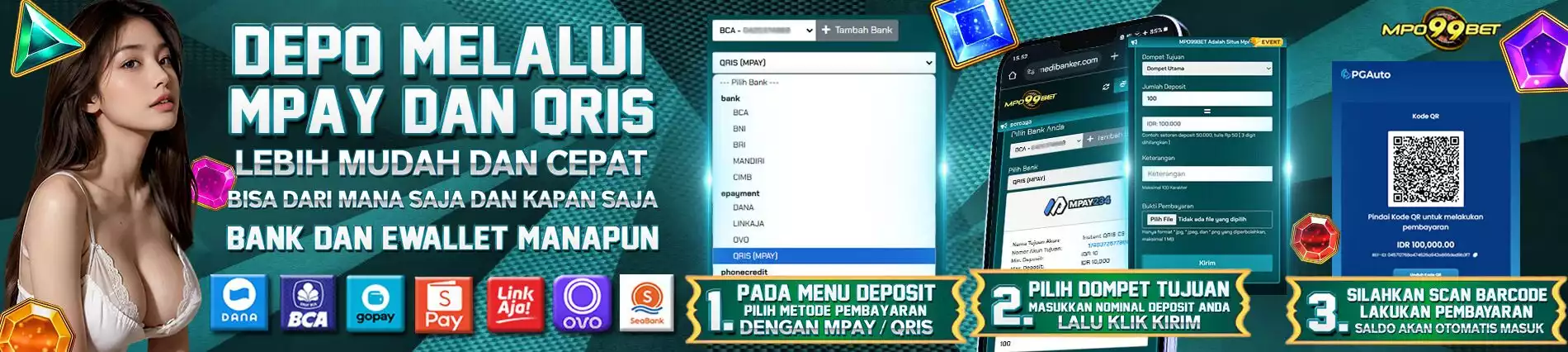

Mpo99bet server mpo hadir sebagai pelopor dalam dunia Permainan online yang kasih Pengalaman yang asyik saat main yang unik dan Keren. Dengan tekad dan komitmen Buat ngasih layanan yang paling top, Mpobet Udah jadi rujukan utama bagi para penggemar judi online. Dikenal sebagai penyedia permainan yang memudahkan, MPO99 Ngepasin berbagai pilihan permainan yang asyik yang dioperasikan via platform Mpobet dengan sistem deposit QRIS yang inovatif. Ini bikin pengalaman main jadi lebih gampang dan efisien dan aman bagi setiap pengguna.